Business Insurance in and around Barnesville

One of the top small business insurance companies in Barnesville, and beyond.

Helping insure small businesses since 1935

- Milner

- Jackson

- Griffin

- Zebulon

- Forsyth

Help Prepare Your Business For The Unexpected.

You've put a lot of time into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's an art gallery, a home cleaning service, a hearing aid store, or other.

One of the top small business insurance companies in Barnesville, and beyond.

Helping insure small businesses since 1935

Surprisingly Great Insurance

The passion you have to be a leader in your field is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Phillip Bell. With an agent like Phillip Bell, your coverage can include great options, such as artisan and service contractors, business owners policies and commercial liability umbrella policies.

Let's review your business! Call Phillip Bell today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

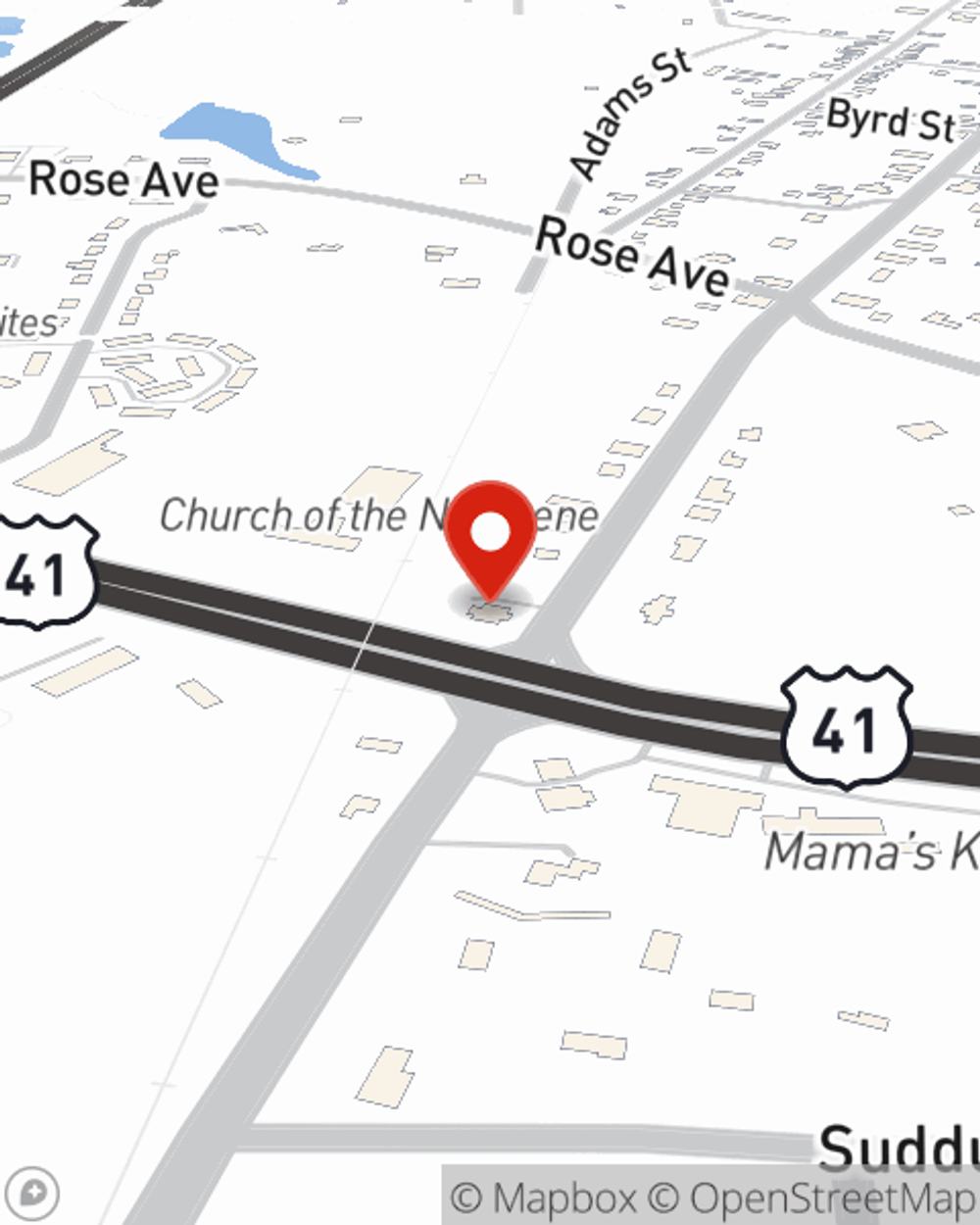

Phillip Bell

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.